The majority (66.4%) of Designers are stuck revising at least a quarter of projects, with each revision costing hundreds to thousands of dollars; nearly one-tenth of Designers have to revise every single project.

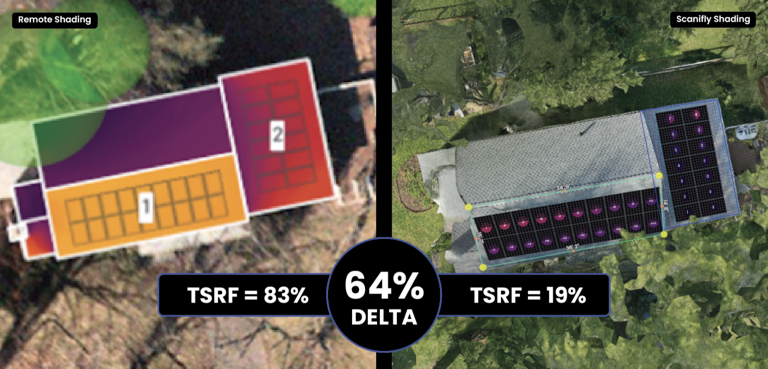

Related, around one-third of arrays modeled with satellite imagery had a greater than 10% delta between estimated and actual production, resulting in a far lower offset for homeowners and considerable change orders.

Why does this happen? One of the biggest drivers for inaccurate designs is due to three words: subjective shade analysis.

Previously, Contractors leveraged the relatively cumbersome and risky (e.g. roof climbs) incumbent handheld tools like the SunEye and Pathfinder. This drove Contractors to alternatives, creating an opportunity for remote tools. Contractors then became reliant on remote imagery due to its speed and ease of use — despite its inherent inaccuracies. As a result, Designers began making subjective assumptions for critical shade analysis inputs.

Note: It doesn’t need to be this way anymore — not only do new technologies make objective shade analysis possible, but inexpensive, faster, and accessible. More below.

What causes the subjectivity in shade analysis?

Many solar contractors minimize cost outlays by deferring a site survey truck roll until after a signed agreement; therefore, they rely on remote imagery for initial shade estimates and sales figures.

This is where subjectivity creeps in.

Remote imagery, such as from satellites, airplanes, or LiDAR data sets, is 2D (except LiDAR), outdated, often blurry, and sometimes doesn’t even exist. This forces Designers to manually extrude and plot property features based on their best guess, including:

- Roof pitch

- Tree heights and tree removal

- Vegetation size and growth rates, particularly for dormant deciduous trees

- The size of dormers, gables, and other roof structure obstructions

- The impact of nearby buildings and topography

Any one of these extrapolations can throw off a shade analysis and impact production estimates. For example, Designers will place fake trees when remote imagery suggests a tree is present. Conversely, it is very common for a tree to have been removed, but the remote imagery is old, so the tree doesn’t exist.

The Z-axis for roof details, tilt, tree heights, and growth rates is estimated using LiDAR, which is often unreliable or outdated. More specifically, the LiDAR from a neighboring two-story house frequently shades a one-story house next to it, which is often missed.

Some use Google Street View, which can be outdated or reference the wrong address. Further, Designers cannot see surrounding obstructions, like neighboring properties, which can overhang where solar will go.

At best, Designers attempt to mimic the on-site scene but inevitably make considerable errors. At worst, Contractors intentionally fudge the sizes of obstructions to optimize a deal’s characteristics for their desired outcome.

The issue is more severe for Contractors working with TPOs — known as Third Party Owners. Because TPOs own the array and economics are based on production, any significant delta between the initially agreed-upon contract and the installed array could lead to financial losses and unhappy customers and sales reps alike.

This plays out in the milestone payment structure for lease financing. Most Contractors submit remote shade reports in the first milestone at closing, and then need to true up the design by installation. However, the economics of the system are often locked in on the first milestone with remote data. Small true-ups and change orders are fairly common and factored in; the risk is a significant delta between the initial agreement and installation due to bad data, which will be costly. This can also lead to TPO rejections and delays in financing payments.

Objectivity is now affordable

Contractors don’t need to face frequent TPO rejections, revision rates, and large true-ups anymore. Using a drone and mobile app for the site survey process—and the right design software—can solve these problems.

Here’s how it works:

- Fly a drone in a circular pattern, taking 100-200 images automatically. This ensures details like tree heights and all obstructions are documented from every angle.

- Capture photos, annotate and mark up images using a mobile app to digitize structural, electrical and property information.

- Process the data to produce a photorealistic to-scale 3D replica of the property, including trees, roofs, and surrounding buildings automatically modeled. This final step removes the manual extrusion and scaling of site data in a remote design, where subjectivity occurs.

This simple three-step approach can be done in far less time than a manual survey and design process and improves accuracy dramatically.

This doesn’t require Contractors to become site technician experts. The key is to collect on-site data in an automated and centralized way. When it comes to leasing, the value compounds further; this data can inform the initial agreement, eliminate the need for revisions, and rapidly speed up the project process. Further, the upfront investment in drones saves Contractors money, drives efficiencies beyond the financing process, and improves safety.

Friction has a solution

The primary cause of friction was a question of cost outlay versus accuracy. This most often stems from when a tree has been removed, but that isn’t reflected in the LiDAR data or remote imagery, or if there is a dispute over the actual tree height. Changing the heights of trees by just a few feet can significantly impact production and pricing.

Contractors value accuracy but want to minimize costs. On the other hand, TPOs just want the planned array to be the one that’s installed; there’s immense pressure and demand for quality work.

Contractors utilizing drones and mobile apps for site surveying and the broader operational processes eliminate this friction. By centralizing real-time, on-site data, every party gets what they want—Contractors save money, TPOs get objective data to inform their business models, and customers get the array they were promised.